Blog

The Hidden Cost of Leverage Trading Fees: A Guide by Referencefee

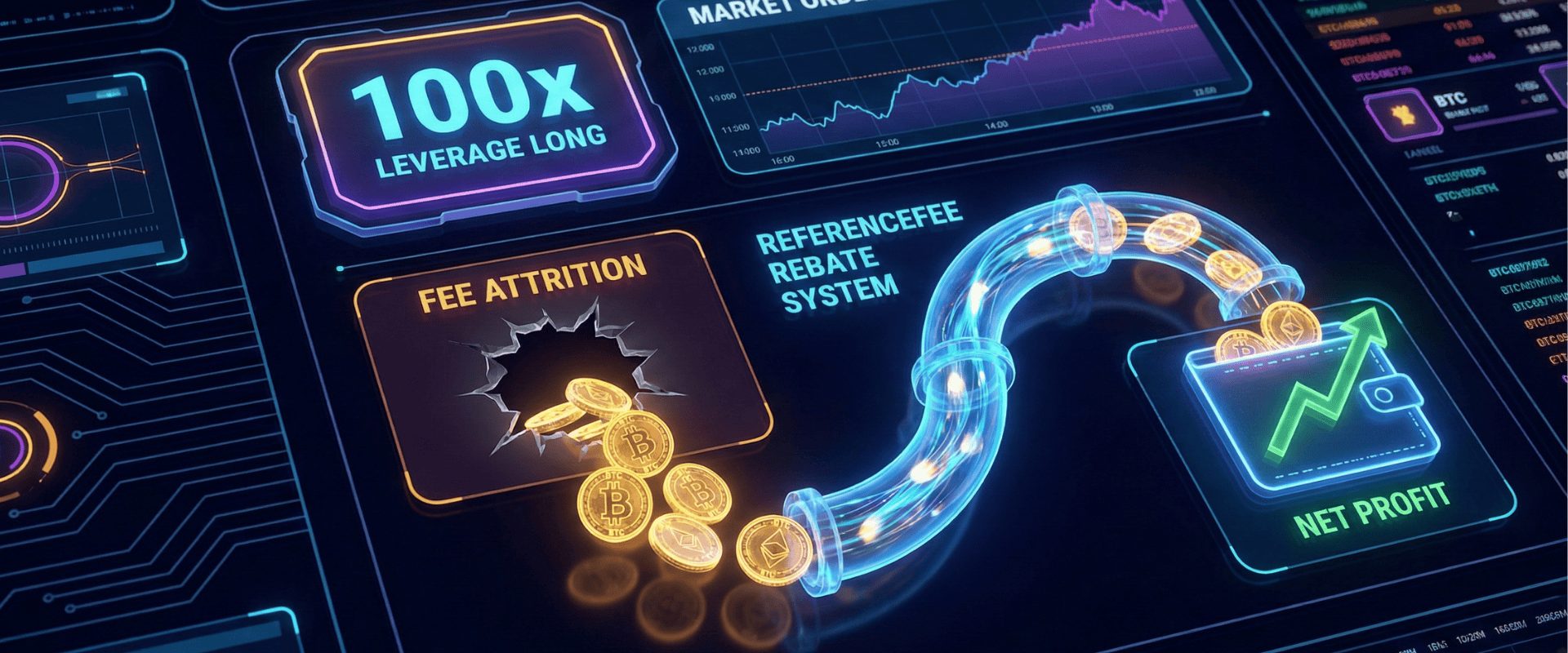

In the high-stakes world of cryptocurrency trading, "Leverage" is often marketed as the ultimate equalizer—a tool that allows a retail trader with $1,000 to command the power of $100,000. While the potential for exponential gains is the primary draw, there is a "silent killer" lurking in every order book: The Notional Value Fee Trap.

If you are an active trader, your biggest expense isn't your losses—it’s the commissions you pay to the exchange. At Referencefee, we believe that every dollar saved on fees is a dollar added to your net profit. In this deep dive, we will break down the brutal mathematics of leverage fees and show you how a professional rebate system can transform your long-term ROI.

- 1 1. The Math of Notional Value: Why Leverage is Expensive

- 2 2. The Compounding Effect of Fee Attrition

- 3 3. Enter Referencefee: Reclaiming the "House Edge"

- 4 4. Why Referencefee is the Professional's Choice

- 5 5. Bridging the Gap Between Retail and Institutional

- 6 6. How to Start Optimizing Your Trading Costs

- 7 Conclusion: Stop Leaving Money on the Table

1. The Math of Notional Value: Why Leverage is Expensive

Most beginner traders make a fundamental mistake: they assume fees are calculated based on their Initial Margin. Unfortunately, exchanges calculate fees based on the Notional Value (Total Position Size).

When you open a position with 1,000 USDT at 100x leverage, you are not trading 1,000 USDT. You are managing a contract worth 100,000 USDT. Even a tiny "Taker" fee of 0.06% applies to that 100,000 figure.

The Breakdown:

Let’s look at the numbers for a standard high-leverage trade:

Initial Margin (M): 1,000 USDT

Leverage (L): 100x

Fee Rate (f): 0.06% (Standard Taker Fee)

The formula for the total cost of a round-trip trade (opening and closing) is:

Plugging in the numbers:

2. The Compounding Effect of Fee Attrition

Professional trading is a game of margins. A trader with a 55% win rate is considered highly successful. However, when you factor in the high cost of leverage fees, that 55% win rate can easily turn into a net loss. This is known as Fee Attrition.

Over a year, an active trader might generate millions of dollars in volume. A retail trader doing 5,000,000 in monthly volume pays roughly 3,000 to 6,000 USDT in fees. Over 12 months, that is up to 72,000 USDT. For most traders, this amount is often larger than their total account balance.

3. Enter Referencefee: Reclaiming the "House Edge"

In a casino, the "house" always wins because of a small statistical edge. In crypto, the exchange is the house, and the fees are their edge. Referencefee was built by software architects and financial engineers to give that edge back to the trader.

A Rebate (or Cashback) system is not a simple discount. It is a strategic partnership where the exchange shares a portion of the commission they collect with us, and we pass the majority of that back to you.

How Much Can You Save?

Using the 100x leverage example from earlier where you paid 120 USDT in fees:

Standard Fee: 120 USDT

Referencefee Rebate (e.g., 40%): 48 USDT

Net Fee Paid: 72 USDT

By using Referencefee, you have effectively lowered your "Break-even" point and kept 4.8% of your total capital in your pocket. In the world of professional trading, a 4.8% saving per trade is the difference between a blown account and a sustainable career.

4. Why Referencefee is the Professional's Choice

There are many "referral codes" on the internet, but Referencefee is a Financial Technology Platform. We provide institutional-grade infrastructure for retail traders.

Transparency Through Engineering

We don’t ask you to trust us; we provide the data. Our custom-built dashboard connects to exchange APIs to track every single satoshi you pay in fees.

Automated Tracking: No more manual spreadsheets. Our microservices architecture syncs your trade data in real-time.

Historical Analysis: See exactly how much you have saved over weeks, months, and years.

No Hidden Clauses: Our rates are among the highest in the industry because we value long-term partnerships over short-term gains.

5. Bridging the Gap Between Retail and Institutional

Institutional market makers and hedge funds never pay full price for fees. They have direct "Rebate" agreements with exchanges. Historically, retail traders were left out of this loop.

Referencefee bridges this gap. By aggregating thousands of traders under one umbrella, we command the same respect and fee structures as large institutions. When you join Referencefee, you are essentially joining a "Trading Union" that fights for your right to keep your profits.

6. How to Start Optimizing Your Trading Costs

Connecting your account to Referencefee takes less than 2 minutes and requires zero sensitive information. We never ask for your private keys or withdrawal permissions.

Select Your Exchange: Choose from our partners like Bybit, MEXC, or OKX.

Create a New Account: Use the Referencefee link to ensure the exchange recognizes you as a "Rebate-eligible" trader.

Link to Dashboard: Enter your UID into the Referencefee portal.

Trade and Collect: Continue your trading strategy as usual. Watch your rebates accumulate in your dashboard and withdraw them whenever you like.

Conclusion: Stop Leaving Money on the Table

Trading is hard enough. Fighting the market, the news cycle, and your own emotions is a full-time job. You shouldn't have to fight the exchange’s fee structure too.

Whether you are a scalper doing 100 trades a day or a swing trader using high leverage, every cent you pay in fees is a hurdle to your success. Referencefee.com is here to remove those hurdles.

Don't let fees be the silent killer of your portfolio. Join Referencefee today and start trading like an institution.